1. Solid and resilient economy

As the Pacific’s third-largest economy, Solomon Islands combines steady growth, low unemployment, and contained inflation, offering a solid foundation for long-term investment opportunities.

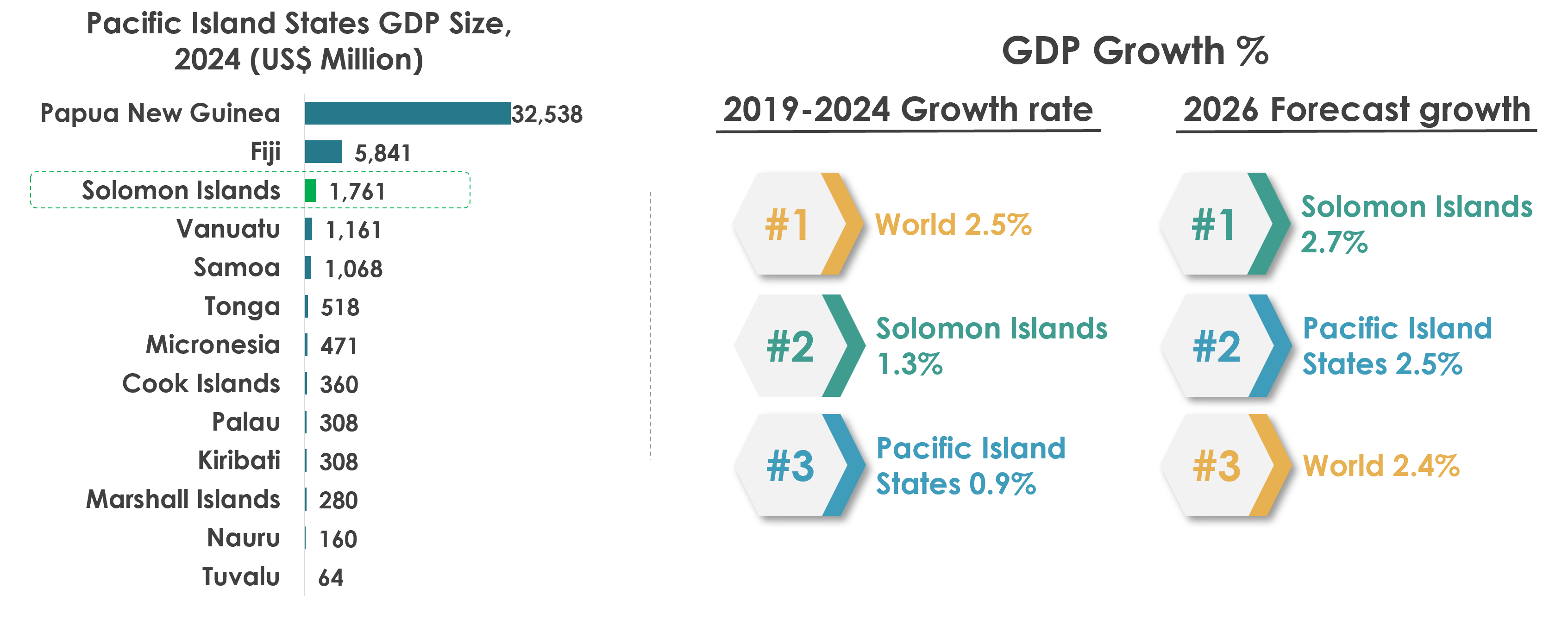

Large and resilient economy

- Large economy: With a GDP of US$1.76 billion in 2024, Solomon Islands is the third-largest economy among Pacific Island States. This scale provides a stronger domestic market and a broader base for investment compared to many of its regional peers.

- Steady performance: Over the last five years (2019–2024), the economy recorded an average annual growth rate of 1.3%, outperforming the Pacific Island States’ average of 0.9%. This steady growth reflects the country’s resilience despite global economic challenges and regional volatility.

- Rapid projected growth: Looking ahead, GDP is forecast to expand by 2.7% in 2026, outpacing both the Pacific Islands average of 2.5% and the global average of 2.4%. This positive outlook signals renewed momentum and growing opportunities for investors in an emerging market.

Note: GDP size at current USD prices; growth at constant prices (2015). - Source: World Bank

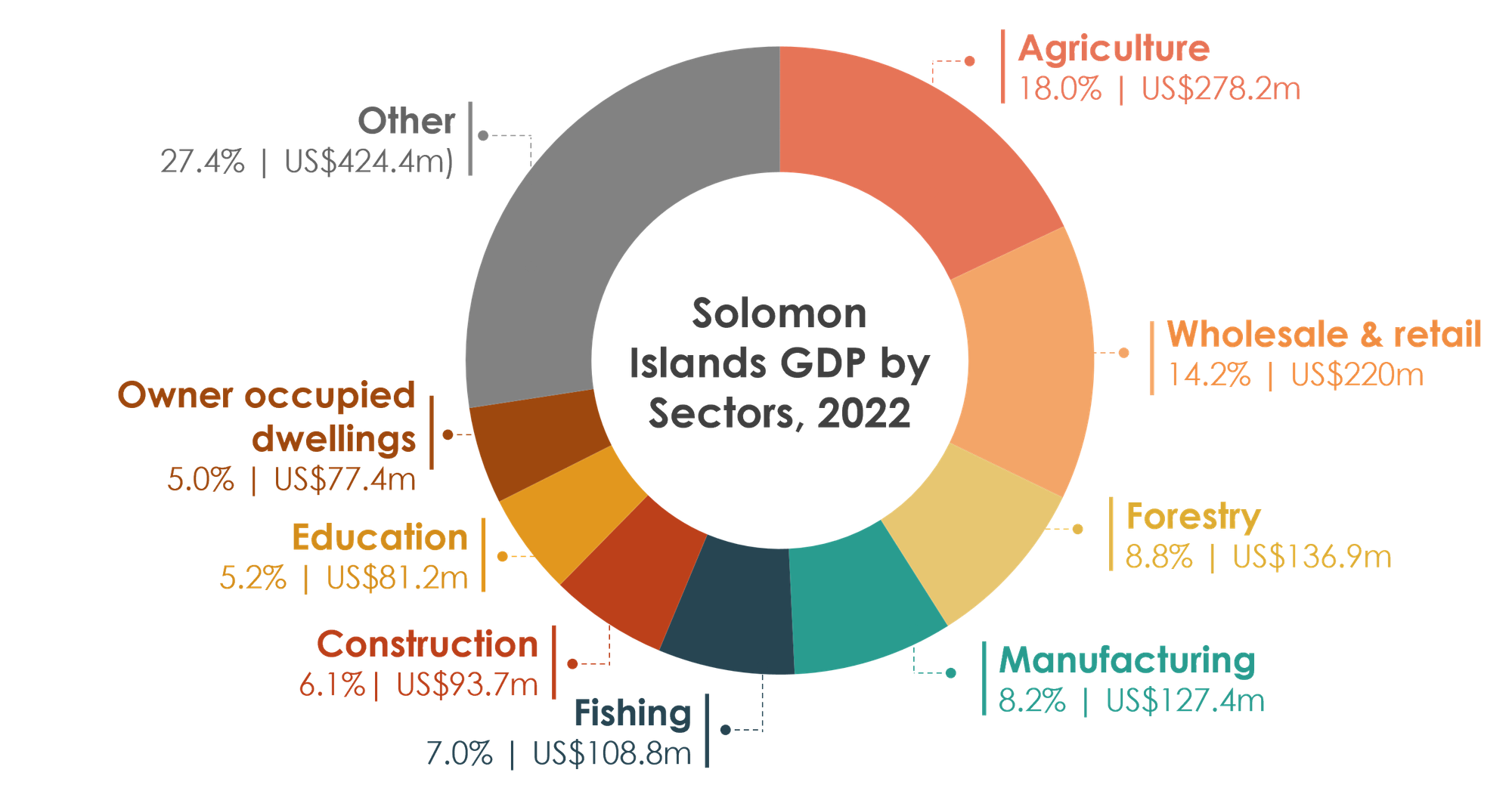

- Diversified economy: Agriculture, wholesale and retail trade, and forestry together contribute more than 40% of GDP, reflecting the country’s strong reliance on both natural resources and domestic commerce. This balance provides a solid foundation for future diversification and sectoral growth.

- Service-oriented economy: Services remain the leading driver of the economy, accounting for 47.3% of GDP. Agriculture, fisheries, and forestry contribute a further 33.8%, while industry represents 18.7%. This structure highlights the importance of services while also emphasizing the significant role of primary industries in sustaining livelihoods and creating opportunities for value-added investment.

Other: Transport & storage 4.0%, Health 2.6%, Electricity & water 2.5%, Communications 2.3%, Hotel & restaurants 1.9%, Mining 1.9%, Other 5.4%. - Note: The estimated sectoral contributions to GDP may contain some inaccuracies due to the high level of informality in the economy and the fact that some payments are received as remittances. - Source: Central Bank of Solomon Islands (GDP at current prices)

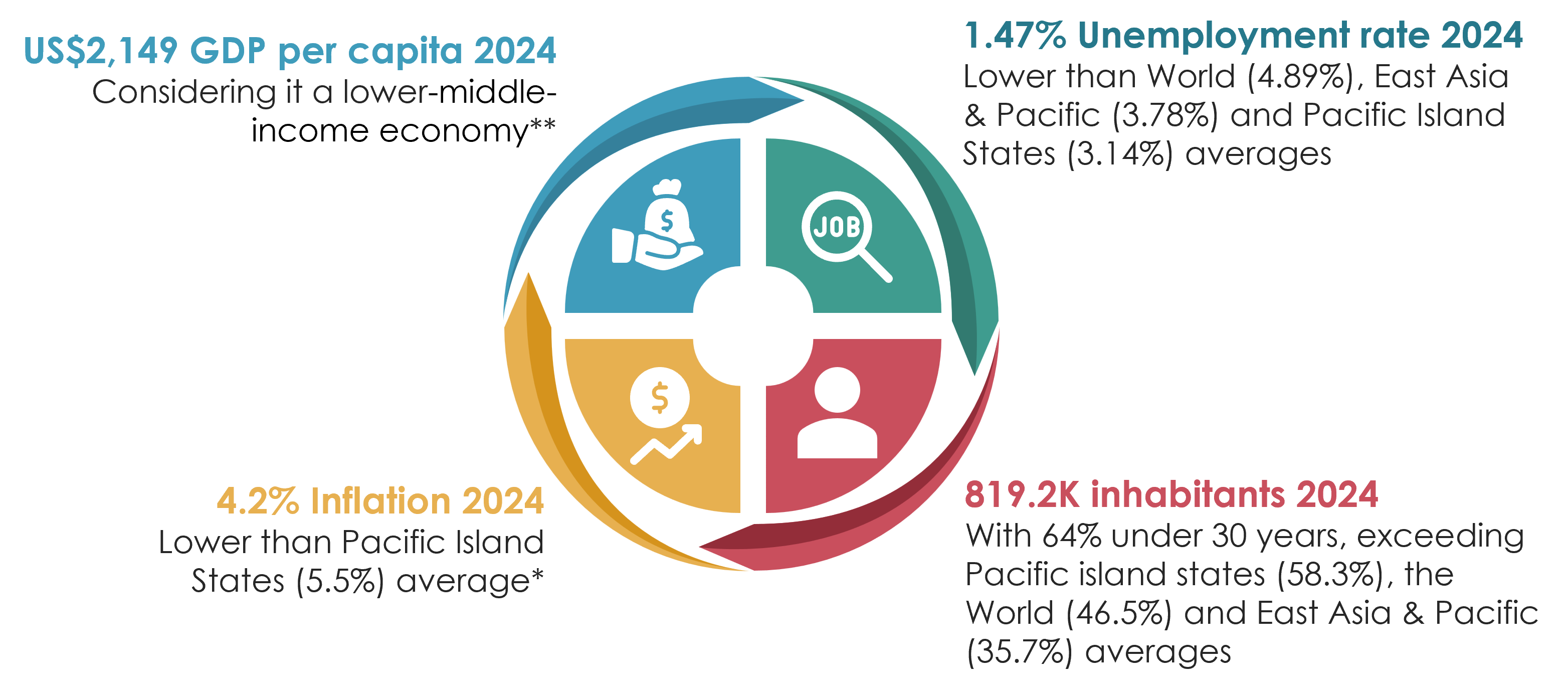

Emerging and dynamic economy

Note: GDP per capita at current USD prices. Inflation average consumer prices. *Estimated by UN Department of Economic and Social Affairs. **GDP per capita between US$1,136 – $4,495. - Source: The World Bank Database / Solomon Islands National Statistics Office

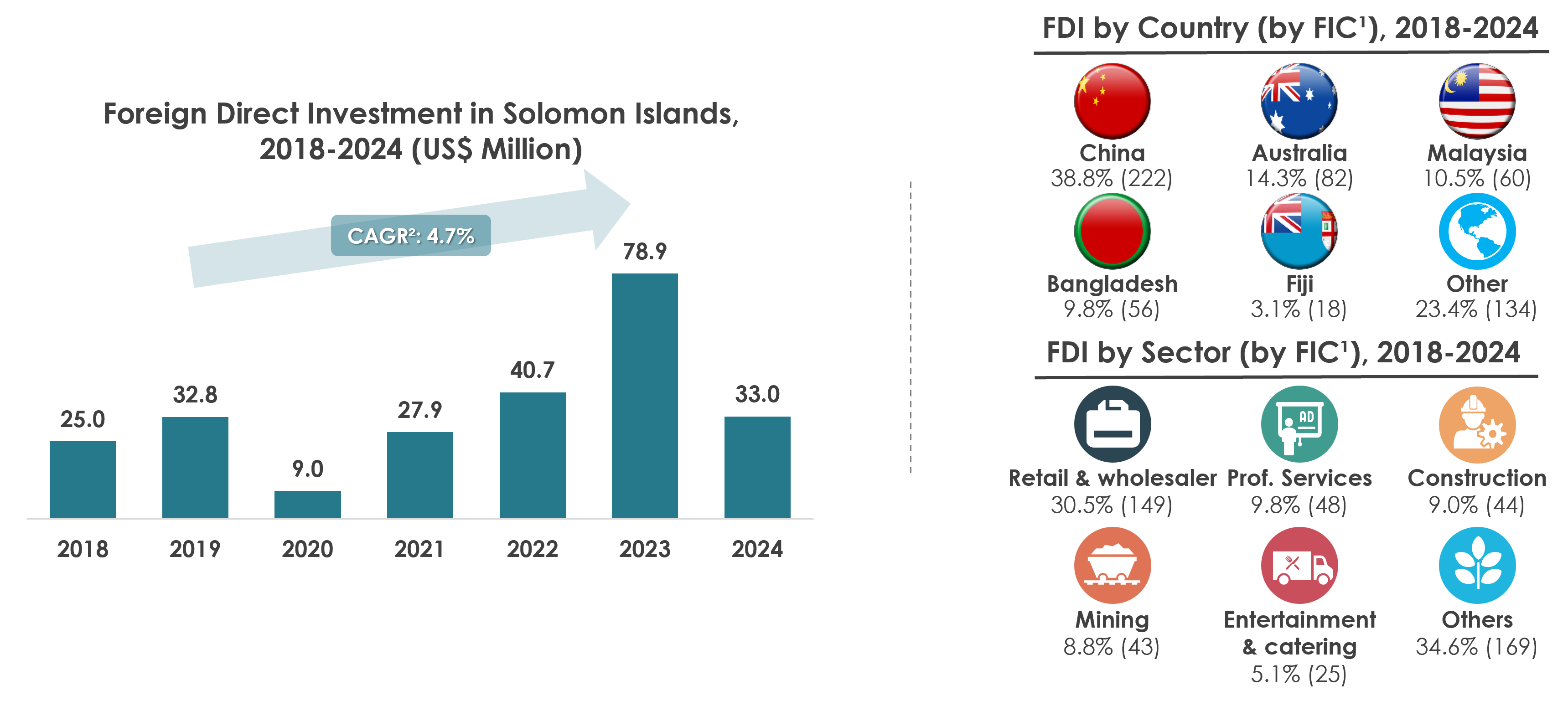

Foreign Direct Investment (FDI) in Solomon Islands

- Steady growth with resilience: Over the past six years, FDI flows into Solomon Islands have grown at an average annual rate of 4.7%, reaching a peak of US$78.9 million in 2023. Despite global headwinds and external shocks such as the Covid-19 pandemic, investment has continued to expand, reflecting the country’s underlying attractiveness.

- Leading sources of investment: China, Australia, and Malaysia remain the top three sources of investment, together accounting for more than 60% of certified projects. This reflects both regional ties and growing global confidence in Solomon Islands as an investment destination.

- Diverse sector opportunities: Investment is spread across a range of industries, with retail and wholesale trade, professional services, and construction emerging as the top three recipients of FDI. Collectively, these sectors represent nearly half (49%) of all certified projects, highlighting the breadth of opportunities available.

¹ FIC: Number of Foreign Investment Certificates issued by the Foreign Investment Division of the Ministry of Commerce, Industry, Labour and Immigration. - Source: World Bank Data base - Ministry of Commerce, Industry, Labour and Immigration

Financial ecosystem in Solomon Islands

The Solomon Islands is served by a range of key financial institutions that play a central role in supporting economic activity and investment across the country.

Source: Central Bank of Solomon Islands (https://www.cbsi.com.sb/solomon-islands-financial-system-infrastructure/?utm)

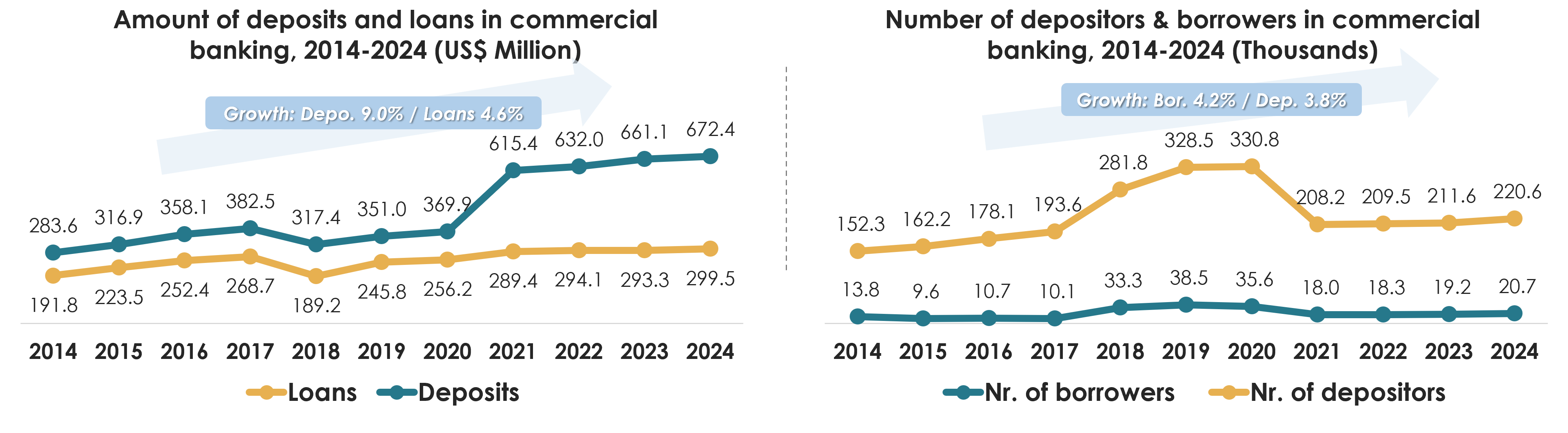

- Steady banking growth: Over the past decade (2014–2024), the commercial banking system has shown consistent expansion, with loans increasing at an average annual rate of 4.6% to reach US$299 million. Deposits grew even faster at 9% annually, climbing to US$672 million, demonstrating the growing confidence of households and businesses in the formal financial sector.

- Expanding financial inclusion: Despite the challenges brought by COVID-19, access to banking services has expanded steadily. The number of borrowers grew by an average of 4.6% per year, surpassing 20,700 by 2024, while depositors rose by 3.8% annually to nearly 220,600, showing increasing reliance on the banking system for savings and credit.

- Broader access to services: By 2024, financial inclusion had widened significantly, with 42.6 borrowers and 453 depositors per 1,000 adults. This trend reflects stronger participation in the banking system and improved outreach across the population.

- Rapid digital expansion: Digital banking has accelerated in recent years, with mobile and internet transactions growing at an average annual rate of 21% between 2018 and 2024. Transaction values surpassed US$156 million, with 11,297 transactions per 1,000 adults in 2024, underscoring the rapid uptake of digital financial services.

Source: IMF (https://data.imf.org/en/datasets/IMF.STA:FAS) - Central Bank of Solomon Islands (https://www.cbsi.com.sb/solomon-islands-financial-system-infrastructure/?utm) - Growth: CAGR (compound annual growth rate)