3. Strong policies, growing stability and clear investment opportunities

The Solomon Islands is a parliamentary democracy with a constitutional monarchy, recognizing the British monarch as Head of State, represented locally by a Governor-General.

The country functions under a unicameral National Parliament, where representatives are directly elected by the people for four-year terms. Since the restoration of peace following the Townsville Peace Agreement in 2000 and the successful completion of the Regional Assistance Mission to Solomon Islands (RAMSI) in 2017, the nation has enjoyed growing political stability and strengthened democratic institutions.

Its legal framework is based on English common law, complemented by local legislation and customary practices, providing a balanced and transparent system for governance and business operations. With steady improvements in political stability, a commitment to the rule of law, and ongoing reforms to enhance the investment climate, the Solomon Islands offers investors a reliable and secure environment to establish and grow their long-term ventures.

Strong and reliable legal framework for investors

¹ ACP - EU Samoa Agreement: African, Caribbean and Pacific Group of States (77 states) - European Union (28 states). Status “signed”. It includes same states from Coconut agreement which status is “in forced”. - ² Pacer Plus: Pacific Agreement on Closer Economic Relations Plus (14 Pacific states). Status “in forced”. It includes same states from SPARTECA which status is “in forced”. - ³ IFD: Investment Facilitation for Development Agreement (World Trade Organization Joint Statement Initiative with 127 states). Status “in negotiation”. - Source: UNCTAD Investment Policy Hub (https://investmentpolicy.unctad.org/country-navigator/199/solomon-islands)

A country committed to peace and stability

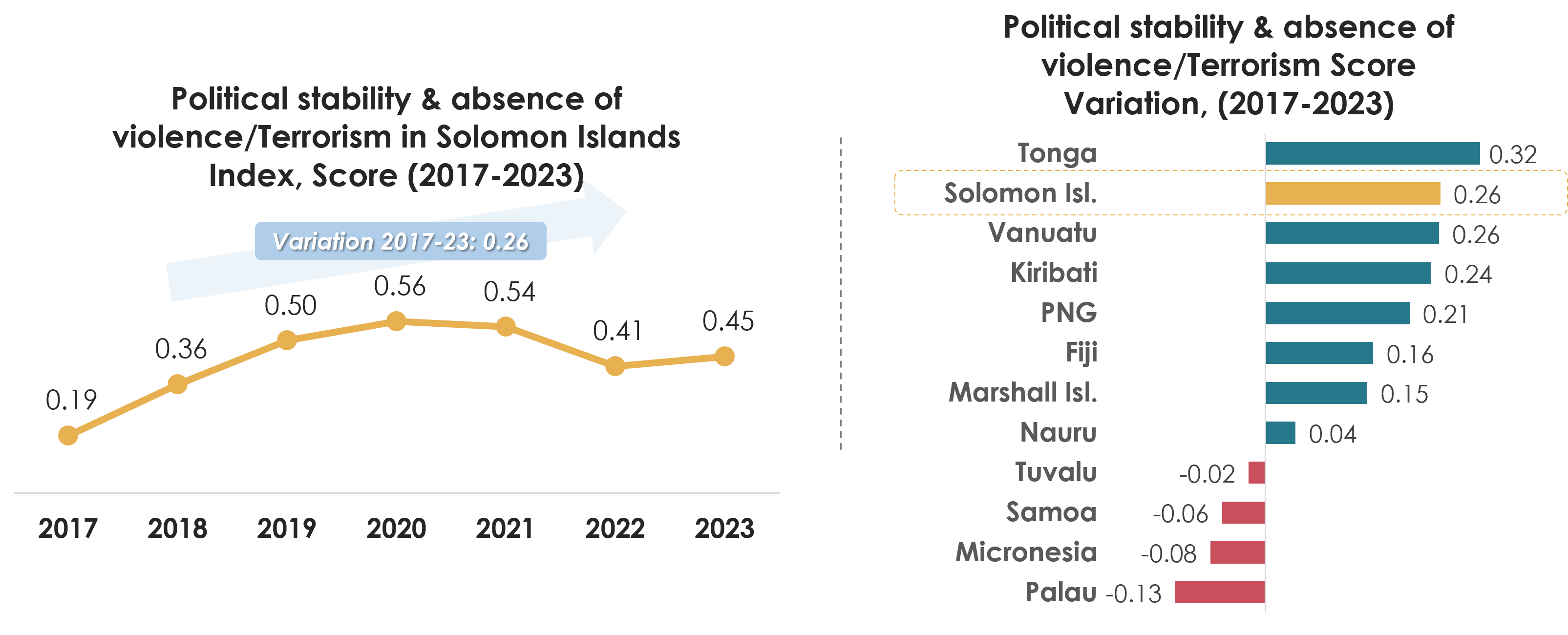

- Growing stability: While the Solomon Islands continues to face challenges, the country has made remarkable progress by nearly doubling its Political Stability & Absence of Violence score, from 0.19 in 2017 to 0.45 in 2023. This steady improvement reflects a more secure and predictable environment, giving investors greater confidence in the country’s long-term prospects.

- Rapid regional progress: With a notable 0.26-point gain, the Solomon Islands is recognized as the 2nd fastest-improving country in the Pacific region. This performance underscores the government’s strong commitment to reforms and stability, positioning the nation as an emerging leader in regional progress and institutional strengthening.

Political Stability and Absence of Violence/Terrorism: Perceptions of the likelihood of political instability and/or politically-motivated violence, including terrorism. * By 2023 Solomon ranked 12th among the 13 Pacific countries. - Source: The World Bank Database (https://databank.worldbank.org/source/world-development-indicators#)

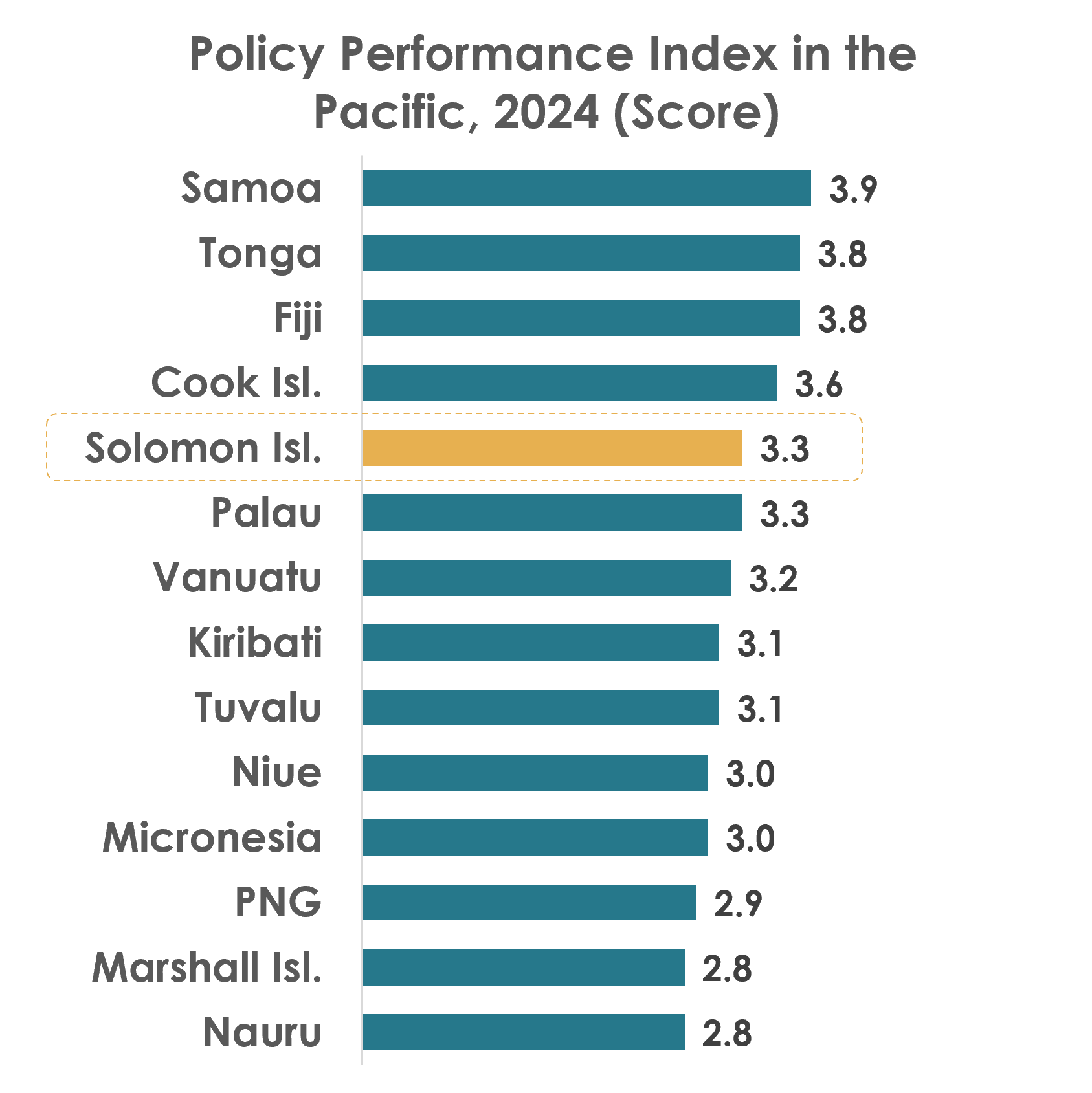

Among the Pacific’s top policy performers

- Solid regional position: The Solomon Islands holds a strong standing in the Pacific, ranking 5th among 14 island states in the Policy Performance Index of ADB’s Country Performance Assessment (CPA). This recognition reflects the country’s solid policy foundations, growing institutional capacity, and increasing competitiveness within the region.

- Investor confidence: Backed by sound frameworks in economic management, structural reforms, and governance, the Solomon Islands provides a predictable and transparent environment. These conditions strengthen investor trust and signal the country’s readiness to support sustainable, long-term investment.

Source: Asian Development bank (ADB) Country Performance Assessment (CPA). https://data.adb.org/dashboard/country-performance-assessment-cpa

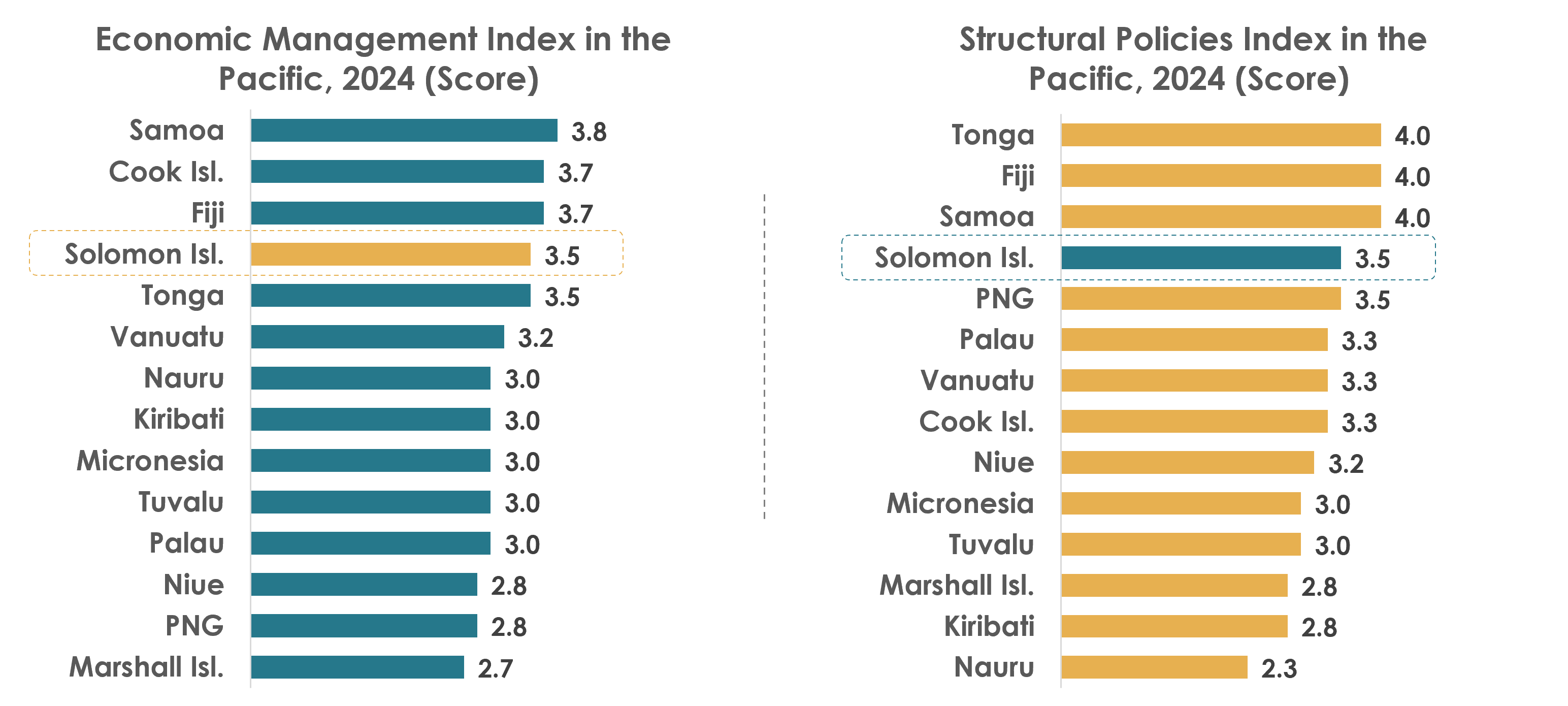

- Strong and reliable Economic Management: It ranks 4th in the Pacific, reflecting disciplined fiscal policies and resilient macroeconomic framework. It also holds #1 in Debt Policy and Management¹ and Monetary and Exchange Rate Policies² subindicators.

- Strong Structural Policy Foundations: Ranked 4th in the Pacific and leads in Financial Sector Development (#1) and performs well in Business Regulatory Environment (#4) subindicators, reinforcing a supportive financial system and pro-investment regulations.

(¹) Along with Tonga. (²) Along with Samoa, Fiji, Cool Islands and Vanuatu. (³) Along with Saia, Fiji and PNG. (4) Along with Cook Islands, Vanuatu and Niue. - Source: Asian Development bank (ADB) Country Performance Assessment (CPA).

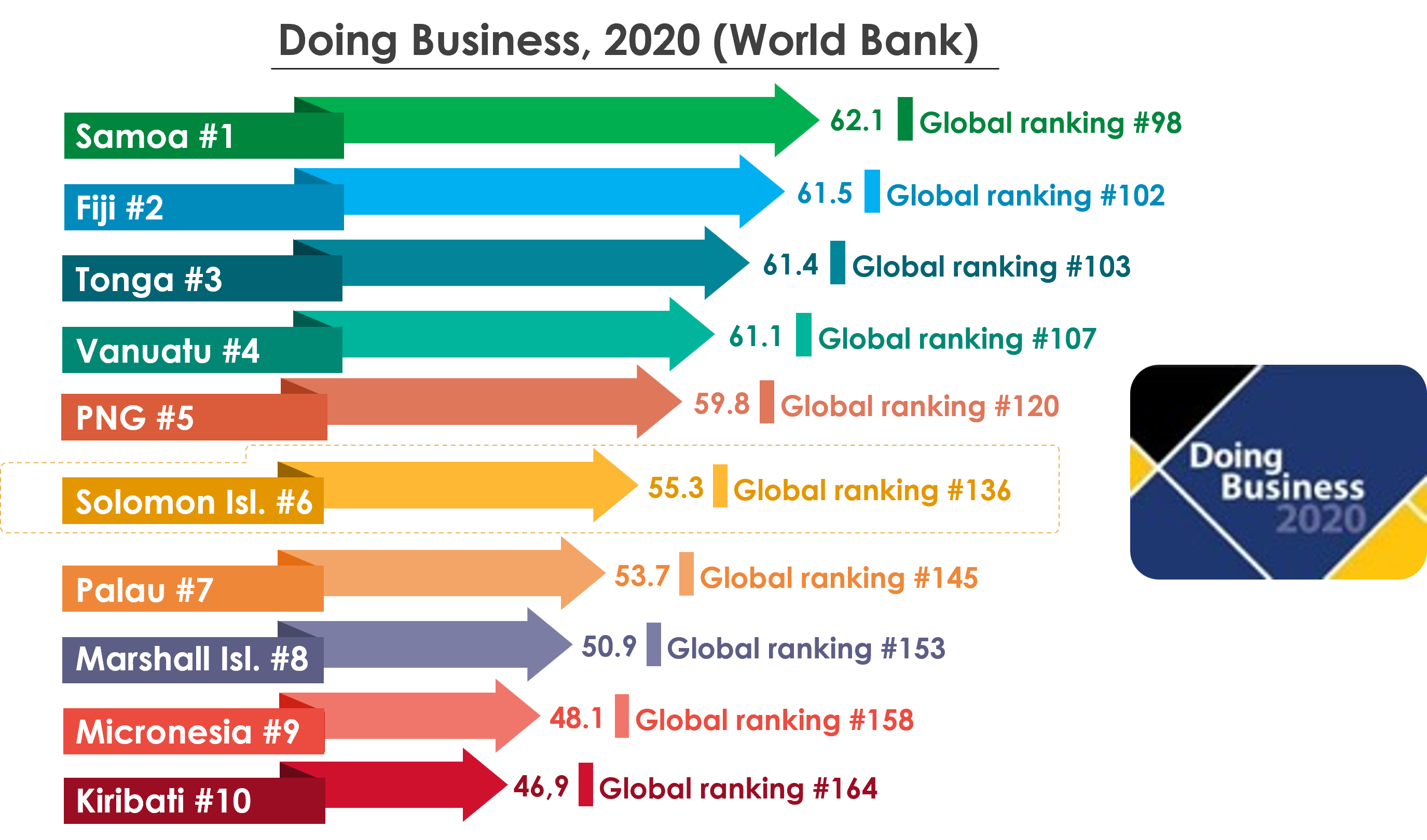

Improving the business climate trough better regulation

- #6 in Doing Business ranking: Solomon Islands is positioned mid-range among Pacific Island states in the World Bank’s Doing Business Index 2020, reflecting steady progress in improving the regulatory environment and support for private sector activity.

- #4 in Protecting investors & Starting a business: It ranks 4th on both subindicators, reflecting stronger shareholder protections, improved governance safeguards, and a streamlined business registration process that enhance investor confidence and ease market entry.

- #1 in Paying taxes: It ranks 1st in the Pacific and #41 globally for Easy of Paying Taxes. This highlights a streamlined, cost-efficient system that reduces business burdens and strengthens investor confidence.

Notes: Higher score implies better position in the ranking. Doing Business 2020 was the last version created by the Word Bank. The new report called Business Ready (B-Ready 2024) only includes Vanuatu and Samoa from the Pacific Islands States. - Source: The World Bank Database Doing Business Report 2020

Portfolio of investable tourism sites

- Portfolio of sites: The Solomon Islands offers more than 60 legally registered tourism sites in the Western Province, identified by the IFC and the Ministry of Culture and Tourism. These sites provide a strong base for sustainable tourism development and new business ventures.

- Ready-to-use land: Each site comes with clear land titles and detailed profiles covering location, size, tenure, attractions, tourism potential, and possible challenges, ensuring investors have reliable information from the start.

- Accessible and pre-assessed: Sites are located within 20 km of airports or one hour by boat, and have been evaluated for tenure clarity, tourism appeal, and environmental and social risks, giving investors an early understanding of opportunities and constraints.

- Strategic hubs: The portfolio is anchored by three hubs—Gizo, known for world-class diving and WWII heritage; Munda, featuring an international airport and lagoon attractions; and Seghe, gateway to Marovo Lagoon and eco-tourism opportunities.

6 Attractive tax incentives to promote country growth

1. New Tourism Investments (1) US$2.4 million (SBD$20m):

- Tax free period: up to 10 years tax holiday for capital investment

- Trading loss tax offset: up to 5 years with ownership continuity

- Import duty exemption: 100% on all capital goods not available locally and renewable energy equipment.

- Accelerated depreciation: 20% deductible in any 5 of 7 years (excluding land). Self-generation & sale: hotels can generate their own electricity and sell excess to the grid.

2. New tourism investments (2) US$120,000 (SBD$1m):

- Investment tax allowance: 55% of capital expenditure deductible against tourism income. Applies to renovations, refurbishments, and extensions.

- Trading loss tax offset: up to 5 years with ownership continuity.

- Import duty & GST exemption: 100% on building materials, furnishings, equipment, and room amenities not made locally. 5% duty on water sports equipment and heavy machinery (with re-export conditions).

- Accelerated depreciation: 20% allowance (excluding land) claimable in any 5 of 7 years.

- Electricity generation incentive: businesses can generate electricity and sell excess power to the grid.

3. Aviation incentives US$605,000 (sbd$5 million):

- Import duty & goods & service tax exemption: 100% exemption on aviation fuel.

- Aircraft investment allowance: 55% of aircraft purchase cost deductible against future business income.

4. Marine & dive tourism investments US$240,000 (SBD$2 million)

- Investment tax allowance: 55% of total capital expenditure deductible against tourism business income.

- Tourism cruise vessel: 100% capital expenditure on vessel purchase deductible against future income; unused allowance after 3 years can offset income from other marine or tourism activities.

- Dive equipment exemption: 100% duty and good tax exemption on imported specialized dive equipment.

5. Tourism joint venture incentives US$1.8m (SBD$15m)

- Extended tax incentive: Additional 5-year income tax exemption for hotel developers or any Tourism-related Business with at least 25% local equity partnership.

6. Existing tourism operators US$2.4m (SBD$20m)

- Income tax exemption: Up to 5 years tax holiday for facility upgrades, renovations, or expansion to meet Tourism Minimum Standards.

- Import duty exemption: Up to 100% on building materials and furniture for required upgrades.

- Renewable energy incentive: 100% duty exemption on renewable energy equipment for tourism facilities under the Upgrade Program.

- Marketing deduction: 150% tax deduction on expenses for overseas marketing and promotion programs.

Special Economic Zones (SEZ)

The Solomon Islands has put in place a legal framework for Special Economic Zones designed to attract investment, stimulate industrial growth, and promote exports (Special Economic Zones Act 2025). SEZs offer benefits such as tax incentives, streamlined procedures, and dedicated infrastructure, creating a predictable and supportive environment for investors while driving diversification and stronger regional integration.

- Definition: Designated area approved by the SEZ Authority to promote investment, diversification, job creation, and sustainable provincial development in agriculture, fisheries, manufacturing, technology, and tourism.

- Economic activities: Export-oriented production; Storage & processing of inbound goods and distribution of outbound goods; Support service businesses; Tourism & recreational developments (excluding casinos and gaming).

- Prerequisites:

- Official designation: Area must be approved as a SEZ by the Authority and Cabinet.

- Financial capacity: Investors must demonstrate adequate funding and technical expertise.

- Minimum capital: Foreign investors required at least US$ 5 million investment.

- Compliance: Projects must meet environmental, social, and labor standards.

- Policy alignment: The proposal must fit within the National SEZ Plan and contribute to exports, jobs, and economic growth.

- Infrastructure development incentive:

- Duty- and tax-free imports of machinery, equipment, and construction materials.

- Duty-free import of one admin vehicle, ambulances, firefighting equipment/vehicles, and up to 2 staff buses.

- 10-year corporate tax holiday, plus exemptions on rent and dividends and stamp duties on transactions and property transfers.

- Automatic visas/work permits up to 5 foreign staff during start-up (4 years).

- Sales tax exemption on utilities.

- Production for customs territory incentive:

- Tax & duty relief on raw materials, capital goods, and equipment.

- 10-year withholding exemptions on foreign loan interest, royalties, fees and dividends.

- Duty-free import of one admin vehicle, one ambulance, firefighting equipment, and up to two staff buses.

- Business visas on arrival for key staff (up to 2 months), and up to 5 automatic work permits during start-up (4 years).

- Free repatriation of profits, dividends, loan repayments, and liquidation proceeds in foreign currency.

- 10-year exemption from PAYE tax on foreign staff salaries and benefits Access to reliable services within SEZs.

- Producing for export markets incentive:

- Access to the export credit guarantee scheme.

- Duty- and tax-free imports of raw materials and capital goods.

- 10-year corporate tax holiday, with exemptions on rent, dividends, and provincial levies.

- 10-year exemption from PAYE tax on foreign staff salaries and benefits.

- Duty-free import of vehicles, ambulances, firefighting equipment, and staff buses.

- Business visa on arrival (up to 3 months), plus up to 5 automatic permits for start-up staff.

- Remittance of proceeds upon sale or liquidation.