Fisheries

- Vital to economy and food security: Fisheries are central to the country’s economy, culture, and livelihoods. With an Exclusive Economic Zone (EEZ) of 1.58 million km²—over 500 times its landmass (3rd largest in the Pacific)— it has some of the world’s richest tuna stocks alongside diverse coastal fisheries, providing food security and significant untapped investment opportunities.

- National commitment and planning: Guided by the National Fisheries Policy 2019–2029 and the Tuna Management and Development Plan, the sector aims to maximize tuna returns, strengthen community-based coastal fisheries, and expand aquaculture. Investments in processing, cold storage, and sustainability further support long-term growth.

- Significant economic contributor: Fishing represents 7.0% of GDP (US$108.8 million), making it the second-largest export earner after forestry. Tuna is the leading commercial activity, while inshore fisheries and aquaculture are vital for nutrition, jobs, and rural development.

- Sustainability and community management: The Solomon Islands is a regional leader in sustainable tuna governance through the WCPFC, and more than 250 villages practice Community-Based Resource Management (CBRM) to safeguard fisheries for future generations.

Potential investment opportunities

- Sustainable commercial fishing: Licensing and partnerships for tuna longline fishing (especially albacore and yellowfin), fleet expansion and modernization.

- Coastal fisheries: Aquaculture farms, hatcheries, and nursery facilities, particularly for seaweed, tilapia, giant clams, sea cucumber and shrimp.

- Processing & value addition: Fish processing plants (filleting, freezing, canning), fishmeal and fish oil production.

- Cold chain logistics: Warehouses, refrigerated transport, air cargo expansion, upgraded fish landing sites.

- Seafood certification: MSC & ASC certification services and traceability systems.

- Maritime repair & resupply: Shipyards, dry docks, marine fuel, and resupply stations.

Industry overview

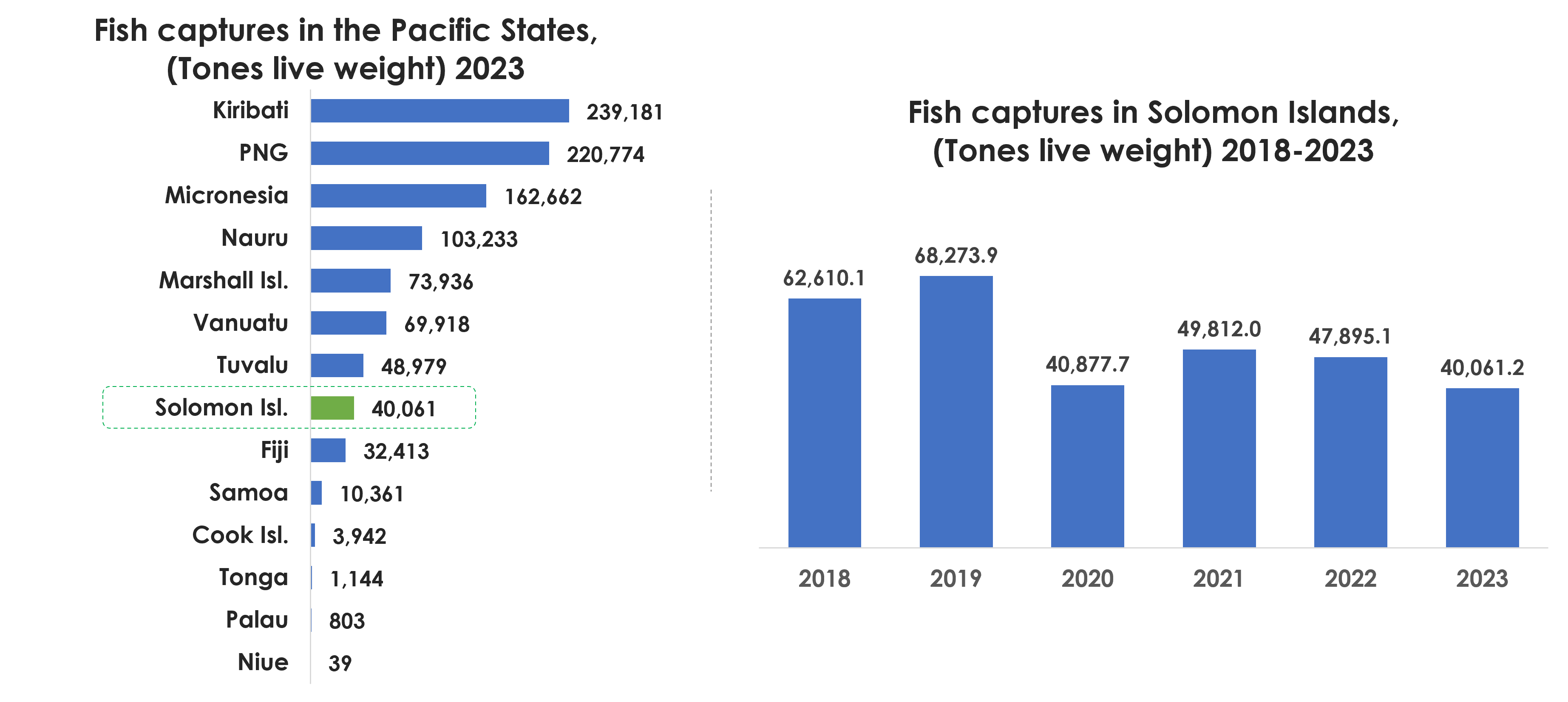

- Strong regional standing with untapped potential: The Solomon Islands captured 40,061 tons of fish in 2023, ranking 8th among the 14 pacific island states. Despite having the 3rd largest Exclusive Economic Zone (EEZ) in the Pacific, current production remains relatively low compared to regional leaders, underlining the vast potential for growth and modernization.

- Volatility highlights opportunity: Fish captures dropped from 68,274 tons in 2019 to 40,061 tons in 2023, an average annual decline of –8.5% over five years. While production has fluctuated, this underlines the urgent need and significant opportunity for investment in sustainable practices, and value-addition to stabilize output and unlock the full potential.

Source: FaoStat (www.fao.org/fishery/statistics-query/en/capture/capture_quantity)

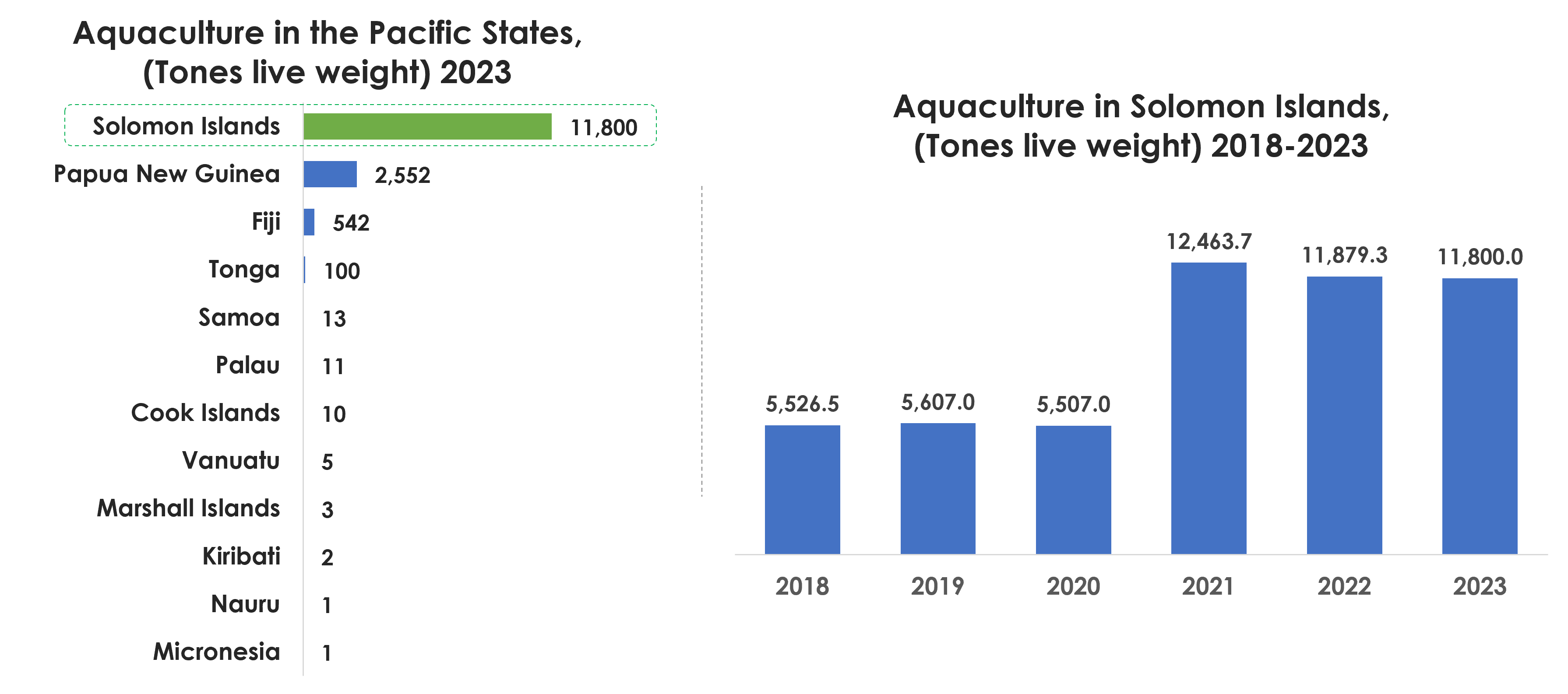

- Pacific leader in aquaculture: The Solomon Islands produced 11,800 tons in 2023, accounting for 78% of all aquaculture output in the Pacific. This makes the country the clear regional leader, far ahead of Papua New Guinea (2,552 tons) and Fiji (542 tons).

- High growth momentum: Aquaculture has more than doubled in the last five years, achieving an impressive average annual growth rate of 16.4%. After steady volumes around 5,500 tons (2018–2020), production surged past 12,000 tons in 2021 and has remained strong, highlighting the sector’s potential to expand further and attract new investment.

Source: FaoSta (www.fao.org/fishery/statistics-query/en/aquaculture/aquaculture_quantity)

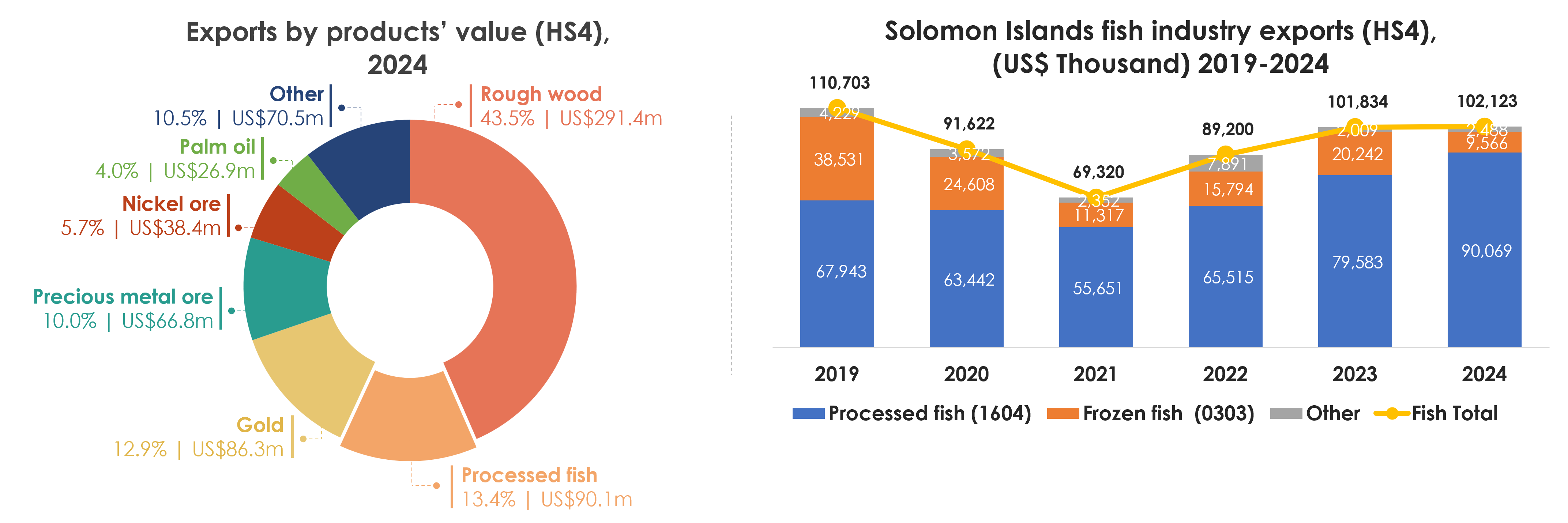

- Fish is a top export sector: Fisheries products represented 13.7% of total exports in 2024, making them one of the Solomon Islands’ top five export categories alongside wood, gold, and metal ores.

- Processed fish (HS 1604): The largest fisheries export, valued at US$90.1 million in 2024, has grown at an impressive 5.8% annual average over the last five years, reinforcing its role as the backbone of the industry and a key driver of export earnings.

- Frozen fish (HS 0303): Valued at US$9.6 million in 2024, frozen fish exports have declined in recent years, pulling down total fisheries exports to an overall –1.6% annual average contraction during 2019–2024. Despite this, frozen fish continues to diversify the export mix and provides room for recovery.

Note: In 2024, frozen fish exports totaled US$9,566 (1.4%), while fish flour exports reached US$2,048 (0.3%). - HS4: Harmonized system at 4-digit code (heading). - Source: www.TradeMap.com (Based on mirror statistics due to the absence of up-to-date official data)

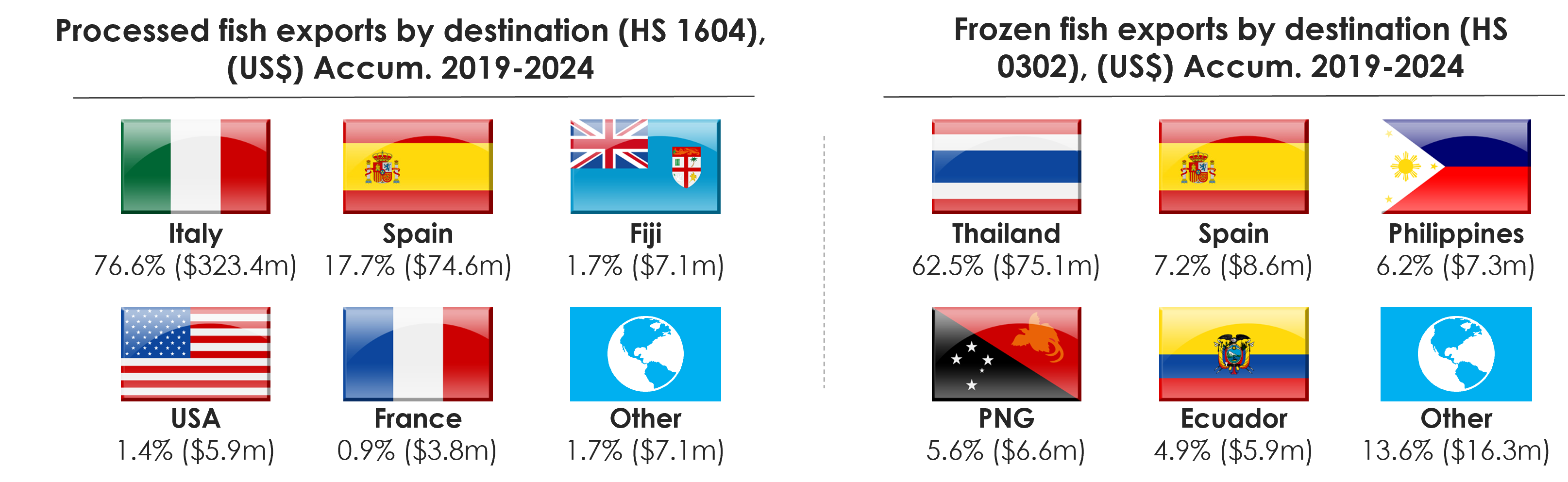

- Export destinations for processed fish: Between 2019–2024, processed fish exports were highly concentrated in Europe, with Italy alone absorbing 76.6% (US$323.4 million), followed by Spain with 17.7% (US$74.6 million). Smaller markets included Fiji, the USA, France, and others, together making up less than 6% of exports.

- Export destinations for frozen fish: From 2019–2024, Thailand dominated with 62.5% (US$75.1 million), while Spain (7.2%), the Philippines (6.2%), and Papua New Guinea (5.6%) were also key destinations. Ecuador and other emerging markets accounted for a further 18.5%, showing growing diversification beyond Asia.

Note: 1604 Product: Prepared or preserved fish; caviar and caviar substitutes prepared from fish eggs. 0303 Product: Frozen fish (excl. fish fillets and other fish meat of heading 0304). - Source: www.TradeMap.com