Tourism Infrastructure

Tourism is one of the Solomon Islands’ most promising growth frontiers, contributing 10.5% of GDP and 10.8% of national employment. With 141 establishments and over 1,600 rooms, the sector already provides a strong foundation for expansion. Coupled with the country’s pristine natural beauty, rich culture, and unique heritage, tourism offers outstanding opportunities for sustainable development, job creation, and high-value investment.

Reasons to invest in tourism

- Pristine natural and cultural assets: The Solomon Islands is one of the Pacific’s last untouched destinations, offering world-class diving, rich biodiversity, WWII history, and authentic cultural experiences. Niche markets like surfing, fishing, bird watching, and eco-tourism are steadily growing.

- Government commitment and incentives: Tourism is a national priority, with investment focused on high-potential areas such as Western Province. The Government supports investors with tax holidays, duty exemptions, and other incentives that reduce costs and improve returns.

- Investment-ready sites: More than 60 legally registered sites with clear titles and detailed profiles are available for tourism development, providing investors with a reliable and well-prepared land portfolio.

- Stable and strategic location: With restored political stability and a secure investment environment, the Solomon Islands is strategically located near Australia, New Zealand, and other Pacific markets, with international airports in Honiara and Munda ensuring easy regional access.

- Improving business climate: Recognized as one of the Pacific’s most active reformers, the Solomon Islands has modernized investment laws, streamlined business registration, and strengthened incentives, making it easier and more attractive to invest.

Investment opportunities

- Accommodation development: Invest in luxury eco-resorts, boutique lodges, mid-range hotels, and guesthouses. Redevelop existing properties in key tourism zones or coastal areas.

- Hospitality & leisure services: Develop wellness retreats, spas, high-quality restaurants, bars, and retail outlets. Offer guided tours, cultural experiences, and sporting activity support services.

- Tour & marine operations: Expand diving centers, boat excursions, cultural tours, sport fishing, and heritage site visits. Strengthen yachting services including marina facilities, vessel management, and maintenance.

- Transport & infrastructure: Strengthen inter-island sea transport through upgraded jetties, improved cruise terminals, and enhanced passenger mobility services (bikes, scooters, vehicles).

- Tourism training & human capital: Establish vocational centers to train hospitality staff and tourism operators. Improve customer service quality and language skills.

- Attractions & cultural sites: Develop visitor centers, hiking trails, wildlife viewing decks, and eco-sites. Revitalize museums, memorials, cultural villages, and historic landmarks.

Tourism products

- Water sports: World-class diving, sport fishing, and surfing experiences.

- Cultural experiences: Traditional performances, village tours, heritage sites, and WWII history.

- Ecotourism: Bird and wildlife watching, guided jungle treks, and nature-based adventures.

- Leisure & lifestyle: Snorkeling, beach activities, yoga, hammock relaxation, and wood carving classes.

Tourism Industry

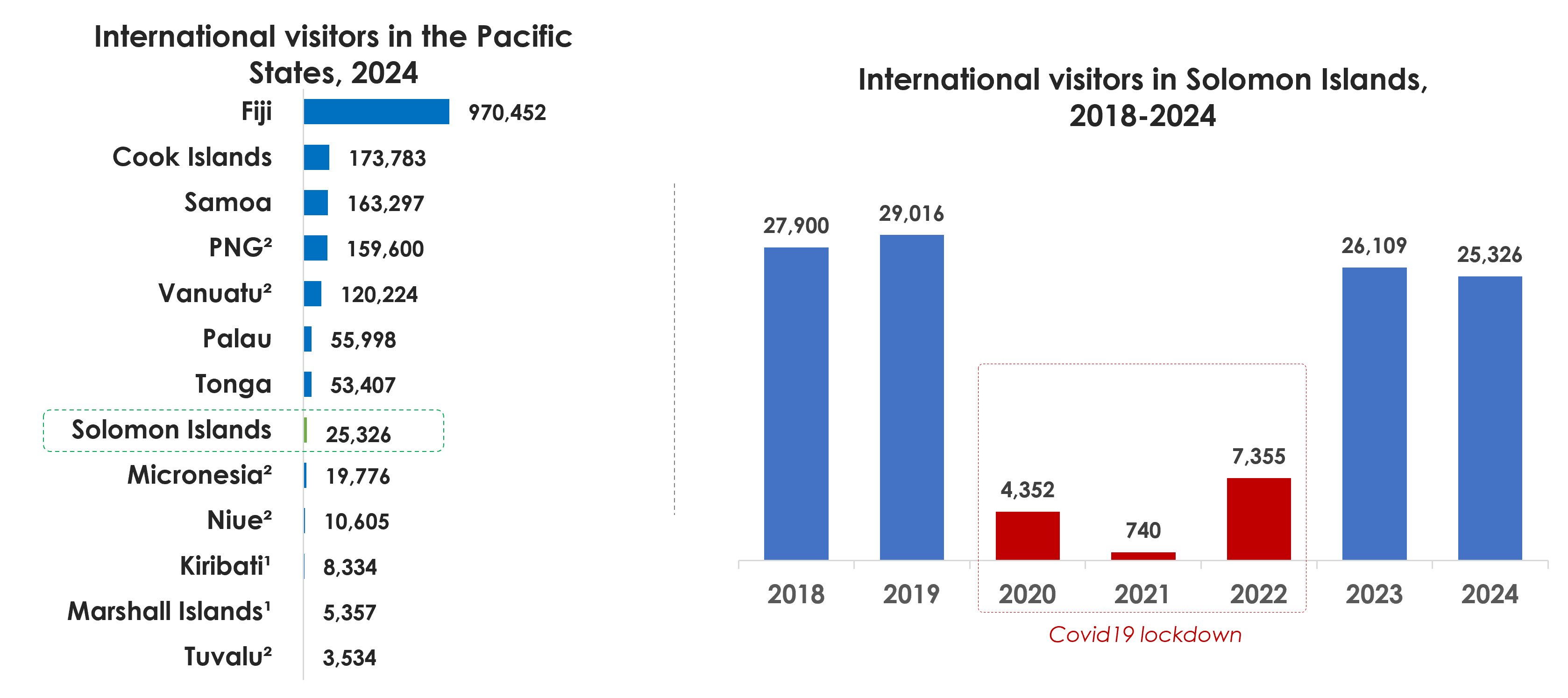

- Young and resilient market: Solomon Islands remains a mid-sized tourism destination in the Pacific, with international arrivals reaching 25,326 in 2024, representing a modest share of total regional traffic.

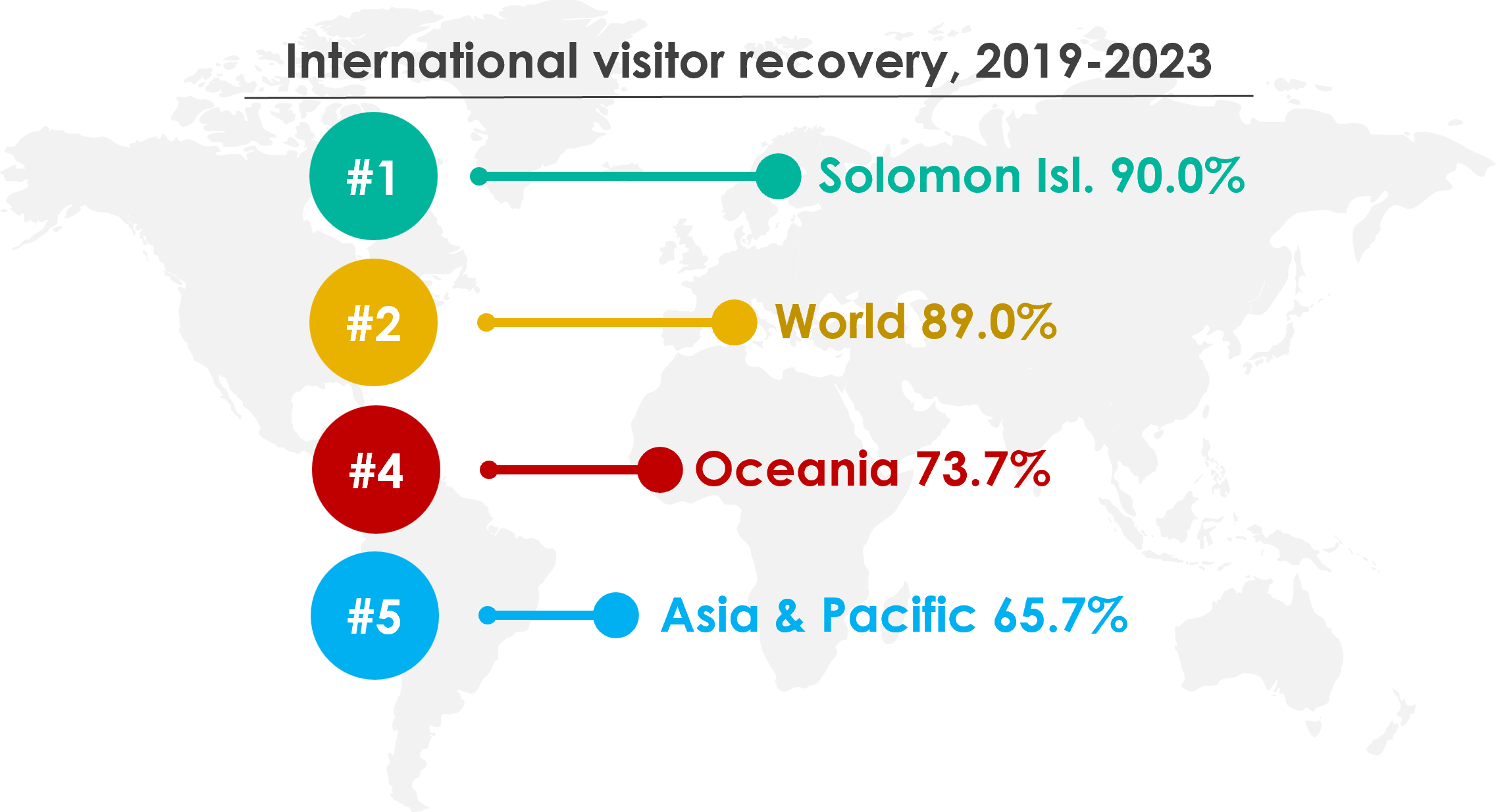

- Strong recovery: By 2023, the Solomon Islands achieved 90% international visitor recovery compared to 2019 pre-COVID levels, higher than the world average (89%) and far above Oceania (74%) and Asia-Pacific (66%).

- Competitive edge: Despite being a small market, with high recovery rates and untapped potential, the Solomon Islands has a chance to position itself as a fast-emerging tourism destination in the Pacific.

(¹) Figures for 2023. - (²) Figures for 2019. - Note: Overnight international visitors https://www.untourism.int/tourism-data/un-tourism-tourism-dashboard

Note1: International visitor recovery: 2023 values / 2019 values. - Note2: 2023 figures are used instead of 2024, as many countries have not yet published updated data, which could distort the results. - Source: UNWTO (https://www.unwto.org/tourism-data/global-and-regional-tourism-performance)

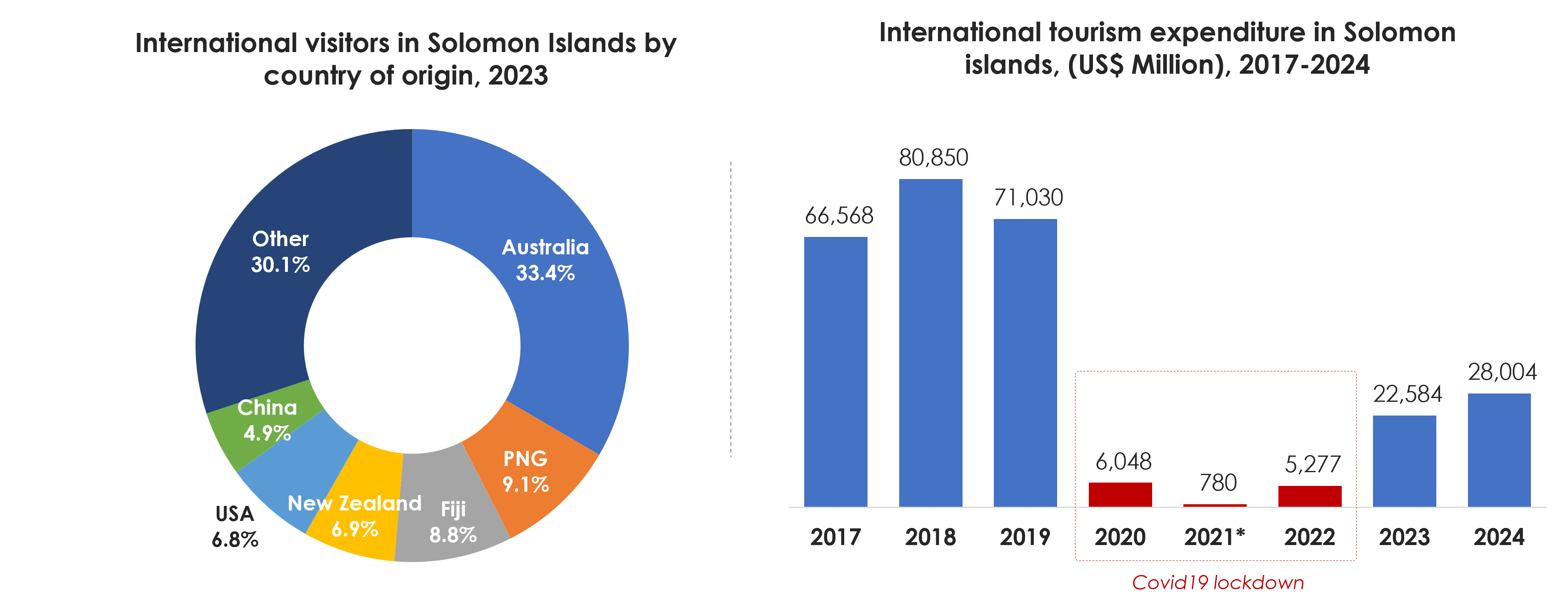

- Key source markets: Australia is the leading source of international visitors to Solomon, accounting for 33.4% of arrivals, followed by Papua New Guinea (9.1%) and Fiji (8.8%). Together, these three markets represent over 50% of total inbound travel.

- Key export service: Travel is the country’s second-largest exported service, representing 21.1% of the export mix after transport (45.2% / US$59.9 million).

- Strong rebound underway: Tourism expenditure recovered to US$22.6 million in 2023 and further to US$28.0 million in 2024, showing steady recovery momentum and renewed confidence. However, earnings still remain well below the pre-pandemic peak of over US$70 million in 2019.

Tourism expenditure: All the spending by foreigners (non-residents) on goods and services while visiting that country (for example, on accommodation, food, transport, entertainment, etc.). - Source: www.southpacificislands.travel / www.trademap.org / www.statistics.gov.sb

- High-value visitors: In 2024, international tourists spent an average of US$3,873 per trip, with flights as the largest expense followed by accommodation. Travelers stayed on average 12 nights.

- Purpose of visit: Holiday travel leads as the main reason for visiting Tonga, accounting for 53% of international arrivals, followed by Visiting family & friends (18%) and Business (17%). Together, these top 3 purposes represent over 88% of total inbound travel.

Source: SPTO (https://southpacificislands.travel/wp-content/uploads/2025/07/Solomon-Islands-IVS-Report-Jan-Dec-2024_FINAL.pdf)

Portfolio of Investable Sites

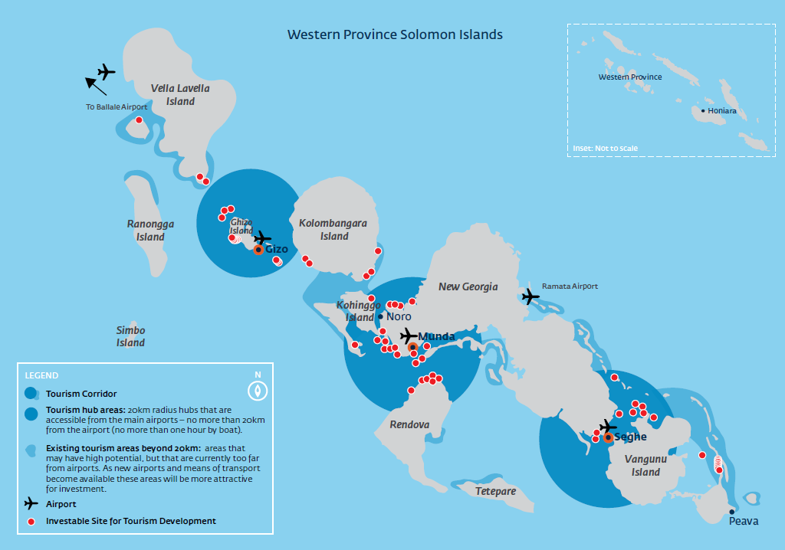

- Comprehensive portfolio: The Solomon Islands has identified over 60 legally registered tourism sites with clear land titles and detailed profiles covering location, size, tenure, attractions, tourism potential, and challenges, offering investors a transparent and reliable pipeline of opportunities.

- Accessible and pre-assessed: Sites are located within 20 km of airports or one hour by boat and have been pre-assessed for tenure clarity, tourism appeal, and environmental and social risks, giving investors early insights into both opportunities and constraints.

- Strategic hubs for growth: The portfolio is anchored by three key hubs: Gizo, known for world-class diving and WWII heritage; Munda, with an international airport and lagoon attractions; and Seghe, the gateway to Marovo Lagoon and eco-tourism opportunities.

Source: IFC & Ministry of Culture and Tourism (2021) Western Province Investable Sites